Why are Investment-Linked Policies, a.k.a. ILPs, such a taboo word in the insurance industry? Is it really a time-bomb waiting to explode, as described by some? On the other hand, advocates for this range of products will say otherwise. The purpose of this article is to present all facts objectively to allow consumers to be your own judge.

Mechanism

I would think ILPs are the most complicated range of products that Financial Planners would ever have to sell, because of all its features and flexibility. Let’s broadly categorise all these into 3 different areas, namely, Premiums, Investment and Expenses.

Premiums

As with all insurance products, there is a price which you agree to pay when you purchase an ILP. This is usually termed as the Regular Premium, or RP. In exchange of the premiums, the insurance company promises a schedule of protection/coverage which is decided when your Financial Advisor does the planning for you.

Investment

The 2nd basket is the investment platform from the different insurers. Generally speaking, all insurance products falls into either one of these category, which is a Term, Whole Life (WL) and ILP. Unlike Term which has no cash value, WL and ILP accumulate cash value as you continue to pay. This is where many people get slightly confused. Many people assume that WL insurance products do not involve investment (in the form of Participating Fund or Par Fund), whereas ILPs are risky investments. This statement is not meant to imply that Par Fund is risky or ILPs are not risky. What I am trying to bring across is that, both WL products and ILPs involves investments. That is what insurers does when premiums are received from all policyholders on a continual basis. However, the key difference between Par Funds and ILPs is, where insurers take charge of the investments of the Par Fund, you have the full control over the unit trust funds that you invest in ILPs. Since the responsibility of managing the investments is passed on to consumers (which most consumers doesn’t), it is important for the investments to be managed together alongside with your Financial Advisor over time, so that changes could be made if necessary.

The strategic investment objectives of a Par Fund is typically 2/3 into Bonds and Fixed Income instruments and the remaining 1/3 into Equities. However, the actual allocation might differ slightly. You can find this information easily from most insurer’s corporate website. Underlying investments in ILPs on the other hand are unit trust funds offered by the investment platform of the various insurers. Technically speaking, if you do 2/3 of bond funds and 1/3 equities, your investment returns should be similar to a Par Fund.

Expenses

Insurance companies, like any other companies in the world, operate for profitability. Therefore, there are fees and charges associated with any products that they sell. In the current context, insurance products are still mainly distributed by Financial Advisors or Insurance Agents. And just like any consumer-facing sales job, there is a compensation structure to reward Financial Advisors for distributing the products. Commissions are generally higher for plans with longer Premium Payment Term (PPT). In order for insurance companies to penetrate the market, they would then rely on their sales force to go out and “sell”. I highlighted this word because “selling” is always seen as unpleasant for most. And many would associate sales person mercenary even till now. I beg to differ. If you are selling by pushing products, yes I would agree the experience will leave a bad taste and you fearful of Financial Advisors in general. However, if products are recommended after a well-conducted financial planning process, to suit best your situation, I believe we can justify the compensation that we receive. I hope to explore this discussion in a separate article in future.

Anyway, the reason I have drifted a little from the topic is just to illustrate that there are fees and charges in all insurance products. And for this reason, the transparency of the fees and charges in ILP makes it even more susceptible for debate. The key charges in an ILP would be as follows: Allocation of Premium, Sales Charge, Service Fee, Annual Management Fee, Administration Charges and Insurance Charges. There might be some I missed out but the following ones should help you understand the mechanism of the fees and charges of ILPs quite completely.

1. Allocation of Premium

Exactly how much of the premiums goes into the investment platform every year? This will be stated in the allocation of premiums. For example, the schedule of allocation might be 20%, 30%, 55% and 105% for the 1st/2nd/3rd and 4th year onwards. i.e. for a RP of $10,000/yr, the premiums going into the investment platform will be $2,000, $3,000, $5,500 and $10,500 respectively. 2 common questions typically arises. First, where does the expenses (i.e. $8,000, $7,000, $4,500 etc.) goes to? Second, why 105% from the 4th year onwards? Expenses due to allocation goes back mainly to the Distribution Cost, in the form of commission, cost of benefits and services paid to the distribution channel. The additional 5% from the 4th year onwards, I would interpret as a form of loyalty bonus. As much as insurance companies wants to have a constant inflow of premiums, they also want to give their customers incentive to do so, so that it’s a win-win situation.

2. Sales Charge

Sales Charge are like commissions when you buy into an investment platform. Just like you pay brokerage fee when you purchase stocks and shares, this is a front-end fee when units are purchased in ILPs. Typically, it could be around 5%. Note that this is a one-time charge only.

3. Service Fee

On an on-going basis, the Service Fee may be applied for the management of the investment account. In my instance, it could be 0.75%, 0.50%, 0.25% or 0% per annum. A portion of the Service Fee then become a trailer fee to the adviser to help with the servicing of the investment account. While some might argue why this is necessary as it detrimental to the eventual Net Asset Value, I think it’s a win-win situation for advisors to have an interest in the AUM so that there is incentive to make sure the AUM continue to grow. After all, would you like to have someone who does not have an interest to help manage your account? In the population of the Benefits Illustration i.e. the projections of Surrender Value, the Service Fee is usually already taken into account.

4. Annual Management Fee

In the same argument as above, just like Service Fee, Fund Managers also charge a fee for the management and investment of the AUM. This could be in the range of 1.2% to 1.6% per annum. In the population of the Benefits Illustration i.e. the projections of Surrender Value, the AMF is usually already taken into account.

5. Administration Charges

Typically, an admin fee of $5/mth is charged for the deduction of units. So that works out to be $60/yr.

6. Insurance Charges i.e. Cost of Insurance

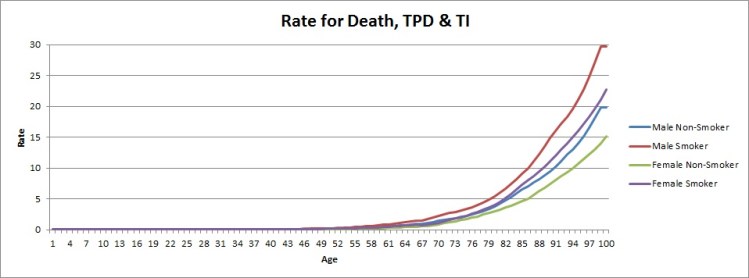

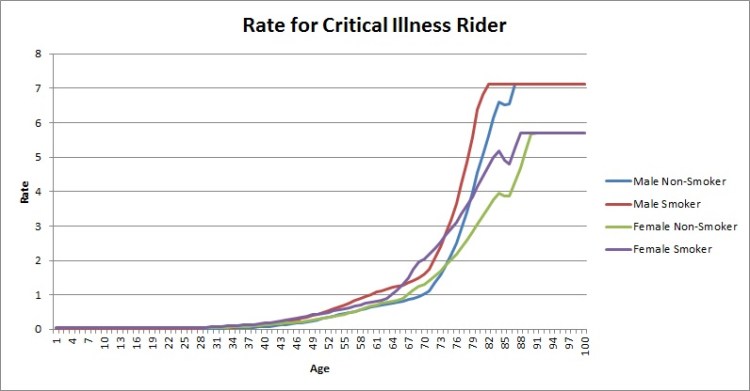

This is the most technical part of an ILP. Insurance is a game of probability and large numbers. Anyone can be an insurance company if you have the ability to absorb the risk. In this game of probability, the actuarial aspect is the key. If the probability of loss is calculated correctly according to the rate of mortality, morbidity and claims experience, insurance companies should never make a loss. Usually, insurance charges are based on a Yearly Renewable Term, which is determined by the age, gender and smoking status of the insured. A simple way to understand this is that, as a person gets older and older, the higher the probability of getting a Critical Illness or to pass on. This is the natural rate of insurance. This is also the reason why there is a time-bomb debate surrounding ILPs. Let’s first have a feel on the rate of insurance in the following charts

The trend that you will notice is, the Cost of Insurance COI, whether for Death, TPD, TI or CI, starts to escalate from Age 65 onwards. Male and Female smokers are charged a higher rate. To have a feel on the actual rates, let’s look at a Male, Non-Smoker, Age 30 who wants to have a protection in place till Age 70 for $500,000 for Death, TPD, TI and Critical Illness.

Term till Age 70

Annual Premium: $2052.25

Total Premium Paid at Age 70: $82,090

Leverage: 1 is to 6.09

YRT COI Option #1 (Insurance Payout Option = Sum Assured + NAV)

COI based on $500,000: ~$173,622

Total Premium based on RP $6,000 ILP: $240,000

Surrender Value at Age 70 @4%: ~$96,031

Claims Benefit at Age 70 @4%: ~$596,031

Surrender Value at Age 70 @8%: ~$416,648

Claims Benefit at Age 70 @8%: ~$916,648

As you can see, while a standard Term till Age 70 represents a pure cost, the outcome from an ILP can be largely different, depending on how the investment works out. However, there is also another way ILP can be configure, when the claims pay-out is the flat amount of Sum Assured, or NAV if it’s higher in value. The figures are show below.

YRT COI Option #2 (Insurance Payout Option = Higher of Sum Assured or NAV)

COI based on 4%: ~$124,397

COI based on 8%: ~$58,203

Total Premium based on RP $6,000 ILP: $240,000

Surrender Value at Age 70 @4%: ~$155,092

Claims Benefit at Age 70 @4%: ~$500,000

Surrender Value at Age 70 @8%: ~$609,431

Claims Benefit at Age 70 @8%: ~$609,431

Why is the COI different at different projected investment growth and from the previous example? Because in this example, the insurance company will pay only the Sum Assured (if NAV is lower), and since NAV constitute the policyholder’s own investment, therefore the Sum at Risk is actually lower as investments build up. i.e. Sum at Risk = Sum Assured minus NAV.

Which way of constructing the ILP is better then? Typically, if you wish to have a higher coverage, then Option #1 is better. But if you would like to grow your investment at a higher rate, then Option #2 will work better. There is really no right or wrong, unless we know exactly when we will die?

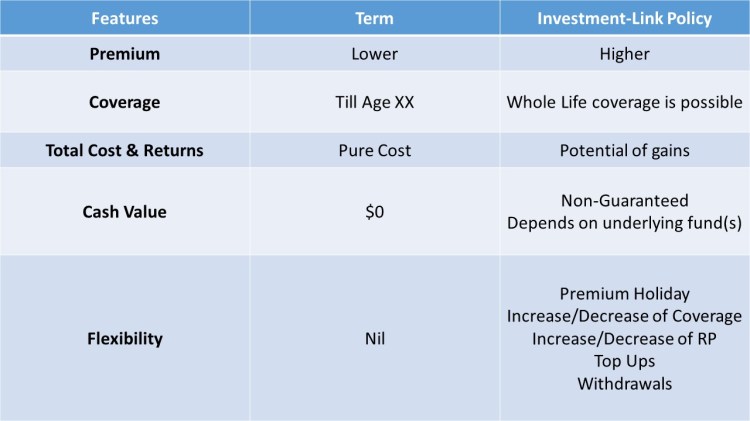

Suitability

While Term is straightforward, the construction of ILP can takes different forms. Term is most suitable for consumers looking for pure protection for a fixed amount set aside every year, till a certain age. ILP can achieve the same function too, but with more flexibility. ILP can also provide for a Whole Life coverage, while most Term doesn’t (yes of course there are Term till Age 99 too). Since a traditional WL insurance can do that too, why ILP then? A key feature that WL policies can’t do but ILPs can is that ILPs allow for a regular withdrawal of your investments, while maintaining the coverage that you have with the insurance company. Therefore you can enjoy your returns and coverage at the same time. For WL insurance, you would have to either take a policy loan at 6% to 8% (which don’t make real sense) or surrender the policy and coverage for the cash value that you have accumulated over the many years. One key thing to note, however is, if you would realise, the underlying fund(s) investment of ILPs is just like the engine of a car. In order ILPs to deliver its full potential, the investments must do well in the medium to long term. Therefore it is absolutely important that a Financial Adviser can do that for you, and to manage it together over time.

Conclusion

Whether ILP is suitable for you or not, depends on how the planning was being done up. With a better understanding of how an ILP actually works, you can then better decide if those are the benefits that works for your situation. Up next I will like to explore Term, WL and ILP lined up side by side to have an easy comparison for consumers.

© Wee Khai

Wee Khai is an avid soccer player, who is also a finisher of 12 half-marathons and 3 full marathons.

One thought on “An Autopsy of Investment-Linked Policy (ILP)”