A brand new year is typically where most people set New Year Resolutions for the year in their personal or professional circumstances. One big area could potentially be getting your finances in order. Our circumstances are unique, and could be complicated such that some tend to conveniently put it off. However, a big goal starts with taking small steps. Let’s explore how we can get our financial plan kickstarted in 3 simple ways.

1. Conduct a Financial Health Check

Taking a snapshot on your current cashflow is a good way to get started. Is “our company’s” finances in order? What are some of the liquid and illiquid assets you are sitting on? Are the liabilities manageable? How does your monthly cashflow look like? This is a spreadsheet I use with many of my clients. If you like to have the excel version, feel free to drop me an email or message.

Alternately, you can also take the easy way out by using this simple formula:

Savings = Income – Expenses

2. Consolidate Your Existing Plans Using MyMoneySense

You can leverage on the government website to get a free and neutral tool to consolidate your finances across participating banks and insurers. Once you give consent, you get to consolidate your data from government agencies, banks, SGX CDP and insurers.

Follow this link ->

https://www.mymoneysense.gov.sg

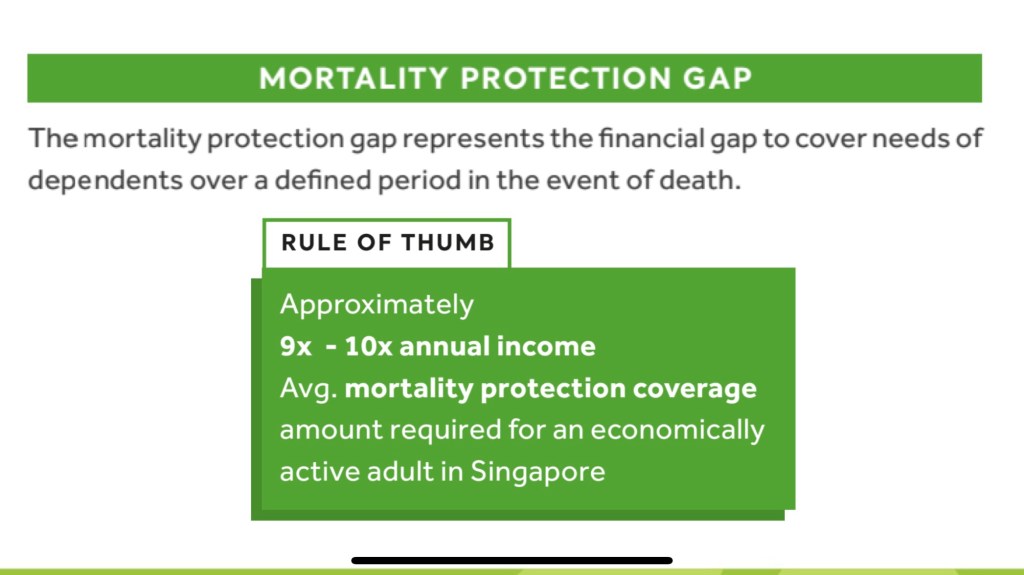

3. Assess Your Potential Shortfall

According to a Life Insurance Association of Singapore – 2017 Protection Gap Study, the Rule of Thumb for Mortality and Critical Illness Protection is 9-10x and 3.9x of Annual Income respectively.

That being said, every individual’s circumstances is unique, but the above give you a benchmark to compare and work on.

Be the 20% to get started and take actions. 2024 will definitely be a better year 🙂

PS: I set a goal to publish 48 articles this year in 2024. Follow my page/website to stay updated! Thank you!

Wee Khai,

Chartered Financial Consultant

“Your Journey to Financial Clarity”