Case Study

What is not covered by Integrated Shield Plans

Following the recent news of a cancer patient facing an ordeal over her medical claims of $320k, I thought it would be appropriate to share some of the few claims experiences I encountered that were rejected.

For the incident that came up in the news recently, the insurer offered to pay only a fraction, or $75,000 – of the hospitalization claim of $320,000. It was alleged that she had not disclose her pre-existing condition at the time of her upgrade of her Integrated Shield Plan. However, it was found that the agent had not completed the form and provided false information not given by the patient. And eventually the claims were approved. This is good news as our industry should allow only the highest level of ethics. But the ordeal was certainly not a pleasant one.

How do we avoid this then? It is therefore important to know what you are buying, what you are covered and what you are not. I hope the following actual case studies will give you a better idea.

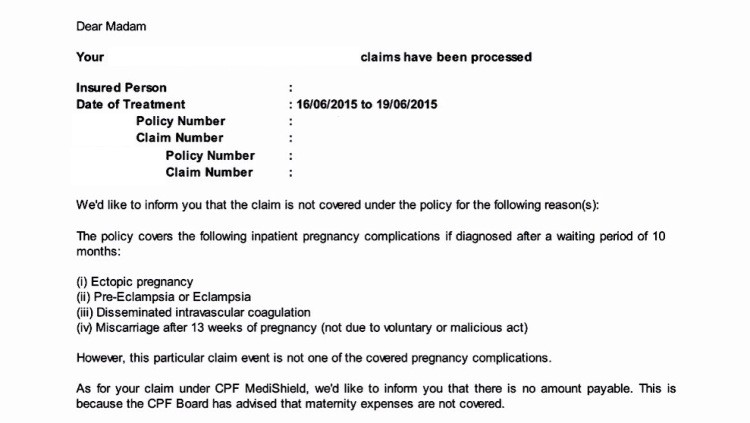

What Is Not Covered: Pregnancy Related Treatments

This exclusion is quite common across most medical plans, unless otherwise specified. Pregnancy and maternity benefits are more commonly covered under Group Hospitalization & Surgical Plans as a rider, or even global health plans. However, defined pregnancy complications are covered under IPs after typically a 10-month waiting period, like the ones defined above.

What Is Not Covered: Deductibles

In the event that you have an IP but did not get the right rider, the initially amount of up to $3,500 would have to be forked out of your own pocket or MediSave. Decide the right level of coverage. Do you want to cover for the Deductibles and Co-Insurances in the event of getting treatment? Do note that if you are purely under MediShield Life, there will be Deductibles and Co-Insurance payable by the patient.

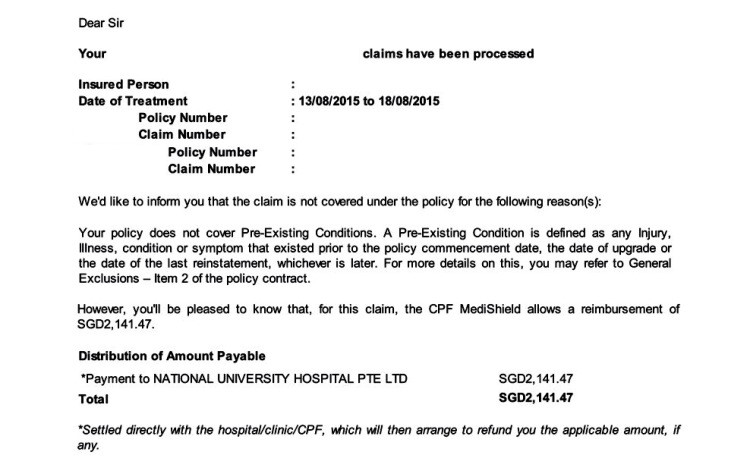

What Is Not Covered: Pre-Existing Conditions

Do be careful if you are considering switching insurer if you have any pre-existing conditions. Instead, upgrade your plan with the existing insurer if you desire a higher level of coverage, so that whatever you are being covered for will remain unchanged, and only the additional portion of the upgrade may (or could) be affected by exclusion if any. In the case of non-disclosure, insurer has the rights to reject the claims, even it was approved initially.

What Is Not Covered: Pre-Existing Conditions (But Covered Under MediShield)

In the event that you have done an upgrade from MediShield to IP with pre-existing condition(s) even though claims could be rejected by the private insurer, the condition could still be covered under MediShield (Life). Because since March 2013, all newborns are automatically included in the MediShield scheme without the need for underwriting. However for MediShield to cover more comprehensively, your ward selection should be a B2/C in a Restructured Hospital.

Conclusion:

- Find out what you are covered and what you are not

- Decide on the right level of treatment you want to go for (hopefully not!)

- Decide if you need to take up a rider to cover for Deductibles and Co-Insurance

- Disclose all relevant information when applying for any products

Ok! Not all is gloomy and negative actually. As a nature of my profession, I do swear by getting your medical coverage done up comprehensively, and as early as possible. Contact your Financial Advisor to clarify your existing portfolio to make sure it is updated to have peace of mind. Medical coverage forms the most basic foundation of any financial portfolio. Do not procrastinate on this.

Up next, I’ll have case studies of actual medical claims which I have administered, that shows how important it is in having a proper coverage without loopholes.

NB: Information presented is correct as of Aug 2015

If you like to understand more, do drop me a message below…