Case Study

How an Integrated Shield Plan Helped My Client Saved ~$21,347

Mdm Fong, Age 66

On Dependent’s Pass

I met up recently with my university friend, who was keen to put in place an Integrated Shield Plan for his mum, who would prefer her to undergo treatment in Singapore than his hometown if situation arises. He had previously delayed this application as he was busy with work and family. So we managed to meet up and run through the plan once again.

In terms of application, Company A does offer the ease of application via Moratorium Underwriting, by which nothing needs to be declared. If Insured does not seek or require any medical treatment of any previous illness in the next 5 years, pre-existing conditions will be fully covered. Of course however, my friend’s mum is still in good health at the Age of 66, and would have nothing to declare if we go through the Full Underwriting. However the challenge of this case was her Dependent’s Pass was going have less than 6 months of validity at the time of application, which was usually a requirement for the application. Her Dependent’s Pass expiry was end-Jan 2016 and it was end-July 2015 at the time of application. So, I wasn’t sure if the application could go through given the circumstances. If not we would have to wait for 3-4 months later as his mum’s routine is to return back to Singapore every 3-4 months for a long visit, and by then her pass would have been renewed. Anyway, I thought we could try applying soonest possible, and the worst case is that we can’t get her Integrated Shield Plan up and we will re-apply the next time she’s back.

So, her application was sent in, in the shortest possible time, and was approved within 3 DAYS! My friend opted for Company A Private Hospital Plan + Co-Insurance Rider, which covers a Standard Ward in a Private Hospital, less Deductibles. It was really lucky that we decided everything so quickly, to get her Hospitalization and Surgical plan up and running, as I would explain why shortly.

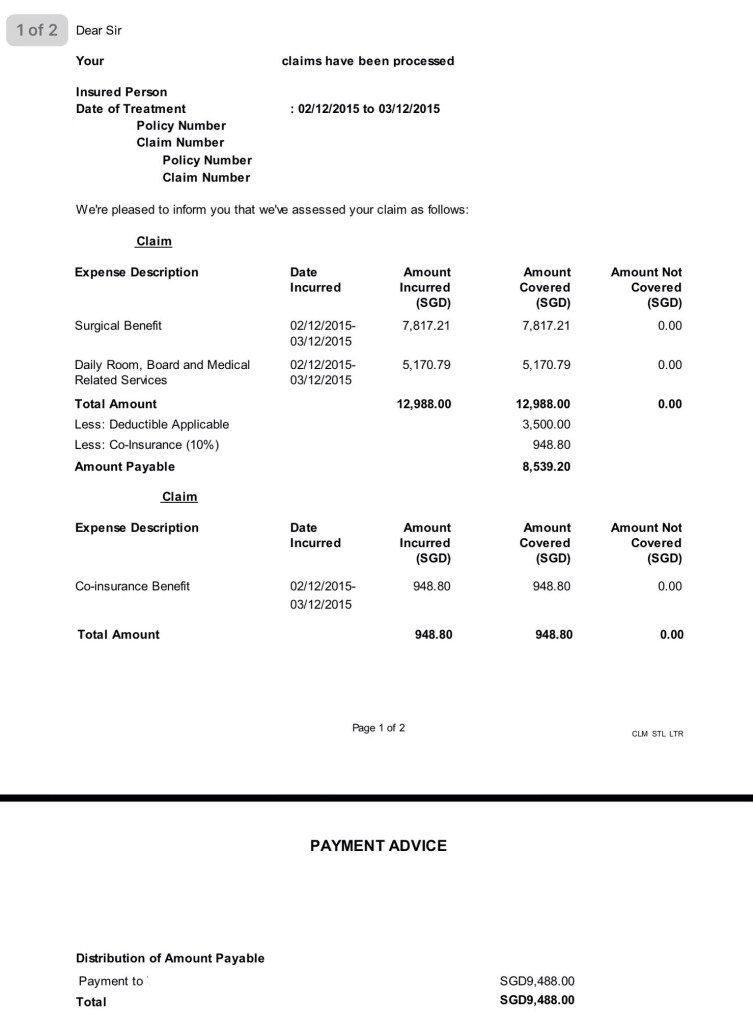

In end-Nov 2015, I received enquiries from my friend on the coverage of her mum’s Shield Plan. That a cancerous lump was discovered and a procedure need to be arranged to removed it. The initial examinations were all done in her hometown, so he wanted to make sure how his mum would be covered for the plan in Singapore. Of course, my first initial thoughts was the sequence of events, and whether that would be considered a pre-existing condition. After clarification, and with her initial medical reports, it was quite clear that the condition was discovered only recently (a few months after her Shield Plan commenced). So then, my advice for my friend was that, her mum would be covered for her procedure/hospitalization up to a Standard Ward in a Private Hospital, less the Deductibles of $3,500.

Above: Surgery alone to remove cancerous lump was already >$10k

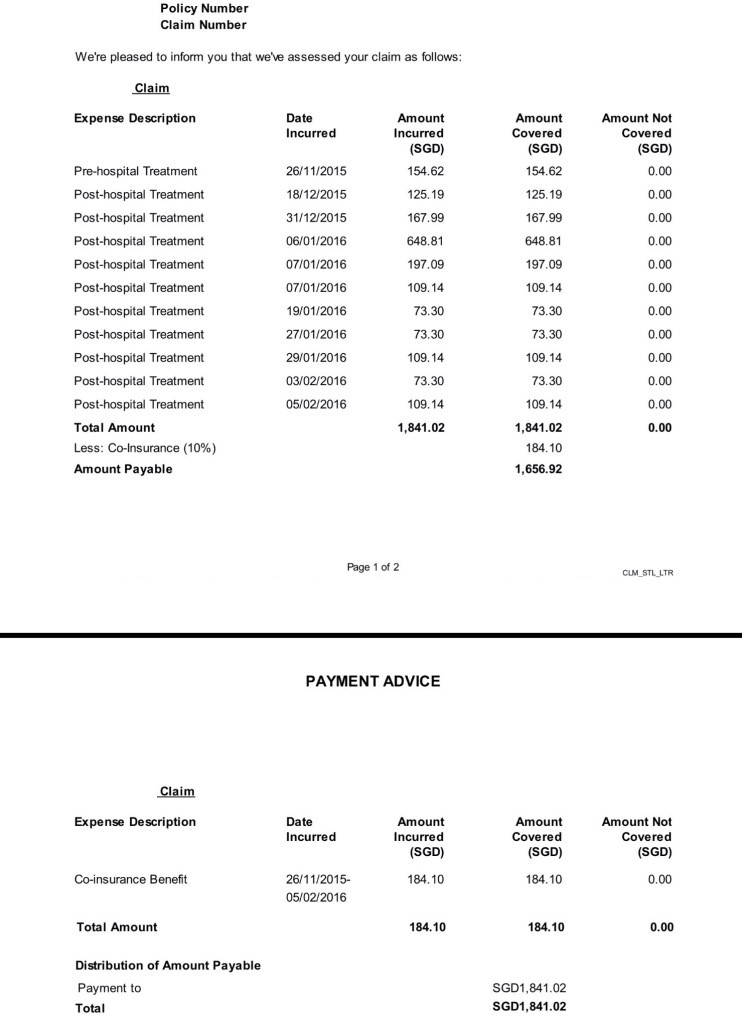

However, through recommendation, my client arranged for consultations for her mum at SGH. And subsequently, an operation to remove the lump with a night stay in the hospital. What followed was a series of radiotherapy as a preventive measure to prevent reoccurrence. In the space of less than 3 months, his mum chalked up closed to almost $25k in medical bills, $24,847 to be exact. Fortunately, with the hospitalization plan and rider, a huge portion of the bill was covered i.e. $21,347, with only $3,500 payable.

Above: Post radiotherapy was equally costly

Luckily we managed to get my client’s mum covered in time, and they did not have to worry about their medical expenses while getting his mum the right treatment. Of course, not needing to claim would really be the best situation. However, having the assurance that the necessary coverage is put in place gives one peace of mind that the risk of incurring huge medical expenses is transferred to insurance companies instead.

Above: Intensive follow up treatment following lump removal

So what’s the takeaway for this short article? I strongly urge everyone to review your portfolio to ensure that it is up to date, without obsolesces, redundancies and loopholes. And when is the best time to do it? The right time is always right now 🙂

NB: Information presented is correct as of Feb 2016

If you like to understand more, do drop me a message below…